| Company: | Blockbuster, Inc. |

| Web Site: | http://www. blockbuster.com |

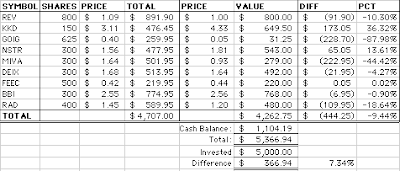

| Purchase Price: | $2.55 |

| Current Price: | Click Here

|

Over the past five years, Blockbuster's stock has fallen, in spite of the fact that the company has continued to prosper. There are two major competitors that were expected to steal their business - but recent events seem to indicate that they may be pulling ahead in the race.

First, Netflix was supposed to make the entire brick-and-mortar video store obsolete - analysts seemed to expect that the vast majority of customers are enthusiastic about technology and will stop shopping in meatspace as soon as a Web site came along to sell the same product, which is the kind of thinking that led to the dot-com crash several years ago.

Netflix has taken a significant number of customers away from them, but has become complacent and imperious, taking away valued services and ignoring the (literally) hundreds of customers who are

complaining and threatening to take their business elsewhere. From their tone, it's unlikely they'll come to the realization that customer service is the key to success, and if they continue along this path, they'll follow in the path of PetSmart and PeaPod to become a footnote in industry history as a warning to others.

The other factor that was supposed to lead to Blockbuster's demise was the consolidation of rival chains: Movie Show Video, a sizable competitor from the opposite side of the tracks, bought out Hollywood Video in an attempt to steal away a significant share of the brick-and-mortar market by spanning more market segments and saturating the market. Unfortunately, it was a bigger pill than they could swallow, and MOVI soon declared bankruptcy.

And while Netflix is screwing their customers, Movie Show is screwing their stockholders, canceling their common shares and planning a reissue to placate their creditors and reward their employees for so efficiently running the company into the ground. After all, it worked for Delta Airlines, right?

And while the competitors who were expected to overwhelm Blockbuster have been busy doing "big" things that turned out to be big mistakes, Blockbuster itself has been quietly keeping its doors open and serving its customers ... and in the long run, that's what really matters.